How does an investor determine their risk tolerance? How can understanding this concept help diversify their portfolios?

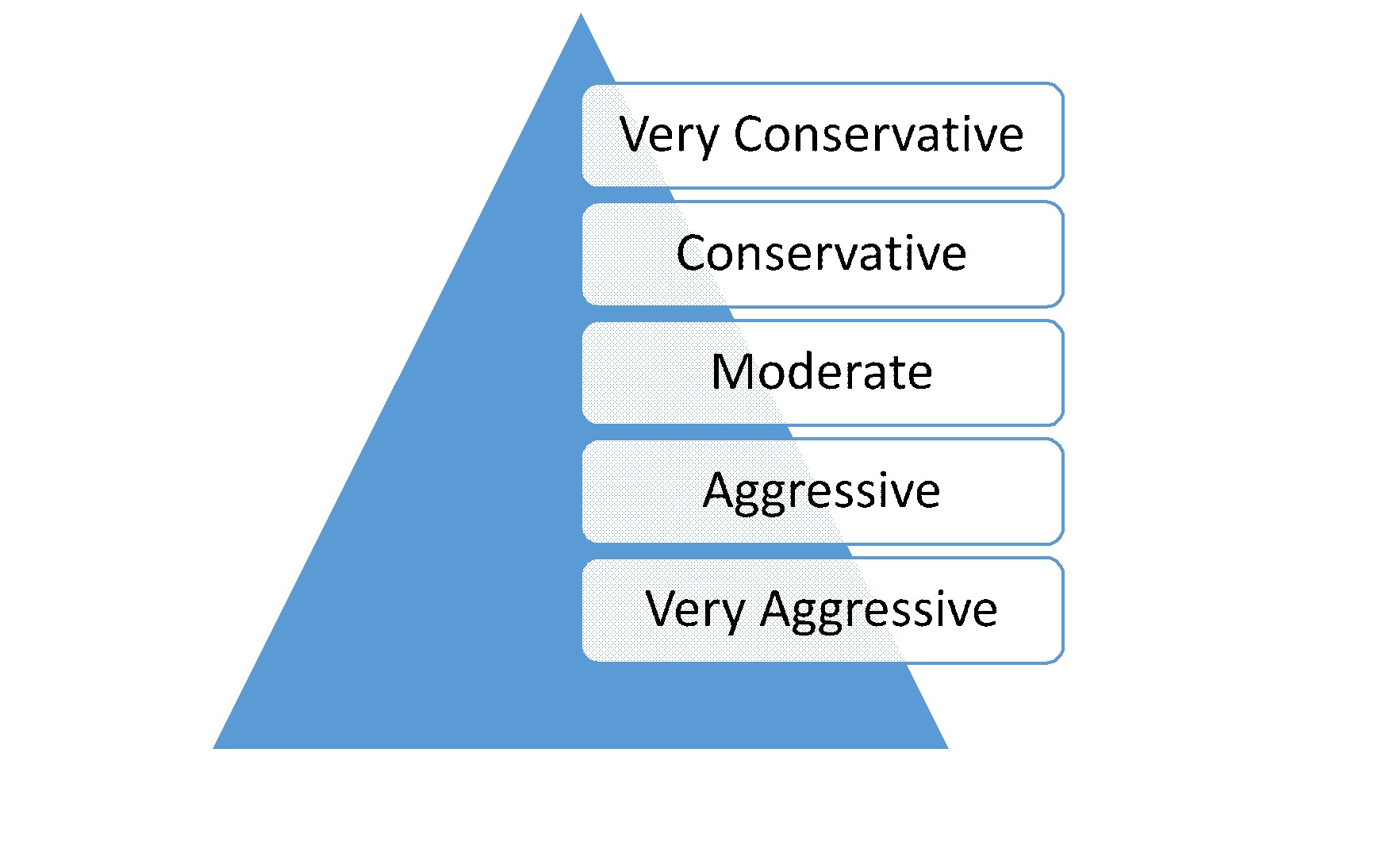

Risk tolerance is a topic that is often discussed, but rarely defined. Risk tolerance is simply a measure of how much risk an investor can handle and is generally measured by the volatility of one’s investment portfolio

There are many factors that go into an investor’s risk tolerance:

What you can afford to lose:

How much money do you have available? What can you afford to lose without impacting your lifestyle? This is not only about having sufficient assets to manage portfolio losses but also whether or not you need access to the funds in a timely manner. How much investment risk you should to take on, is determined by each investor’s individual circumstances. If you have a mortgage, own a business or have college age kids, you may be less inclined to ride out a bear market than if you are single and without major debts.

Time frame:

The length of time remaining until you are planning to retire factors into how much risk your portfolio can handle. As retirement approaches, many investors have a lower risk tolerance, since they don’t have as much time to rebuild should riskier investments cause a loss. Consider your time frame as you determine your risk tolerance. If the time frame is shorter, risk tolerance should be more conservative. For long-term investments, there is opportunity for a more aggressive strategy.

Emotional impact and risk tolerance:

Risk tolerance includes your financial ability to handle a certain level of risk, as well as your emotional ability to deal with risk. If risky investments could potentially cause you stress or anxiety to the point where it is affecting your daily life you may want to consider lower risk portfolio options.

Investment Experience

When determining your risk tolerance, your level of investing experience should be considered. Are you new to investing? Have you been investing for a while but are branching into a new area? It’s important to start new ventures with caution, investing is no different. In addition, if you have realized material investment losses in the past, this may have an impact on how you approach risk in the future. The most important thing is to know yourself and be honest about your feelings with your financial advisor. Your advisors will strive to construct your portfolio in a way that will effectively achieve your financial goals within a level of risk you feel comfortable.

Our risk tolerance changes over time. Age, income, and goals all affect your level of risk tolerance. As your life changes, you will find that your risk tolerance rises or falls. Use our helpful calculator to help determine your risk tolerance*.

* The Risk Tolerance Calculator is designed to help you decide how to allocate your assets among different asset classes (stocks, bonds, and short-term reserves). You are under no obligation to accept the suggested allocations provided by this questionnaire.

The allocations provided are based on generally accepted investment principles but can’t take into account all the possible circumstances and situation’s that affect your portfolio. There is no guarantee, however, that any particular asset allocation or mix of funds will meet your investment objectives. All investments involve risks, and fluctuations in the financial markets and other factors may cause declines in the value of your account. You should carefully consider all of your options before investing. Past performance is not indicative of future results.

The Risk Tolerance Calculator is provided to you free of charge. It does not provide comprehensive investment or financial advice. NEIRG is not responsible for reviewing your financial situation or updating the suggestions contained herein.